Fascination About Frost Pllc

Fascination About Frost Pllc

Blog Article

Not known Details About Frost Pllc

Table of ContentsThe Best Guide To Frost PllcGetting My Frost Pllc To WorkFrost Pllc Fundamentals ExplainedThe 3-Minute Rule for Frost PllcHow Frost Pllc can Save You Time, Stress, and Money.

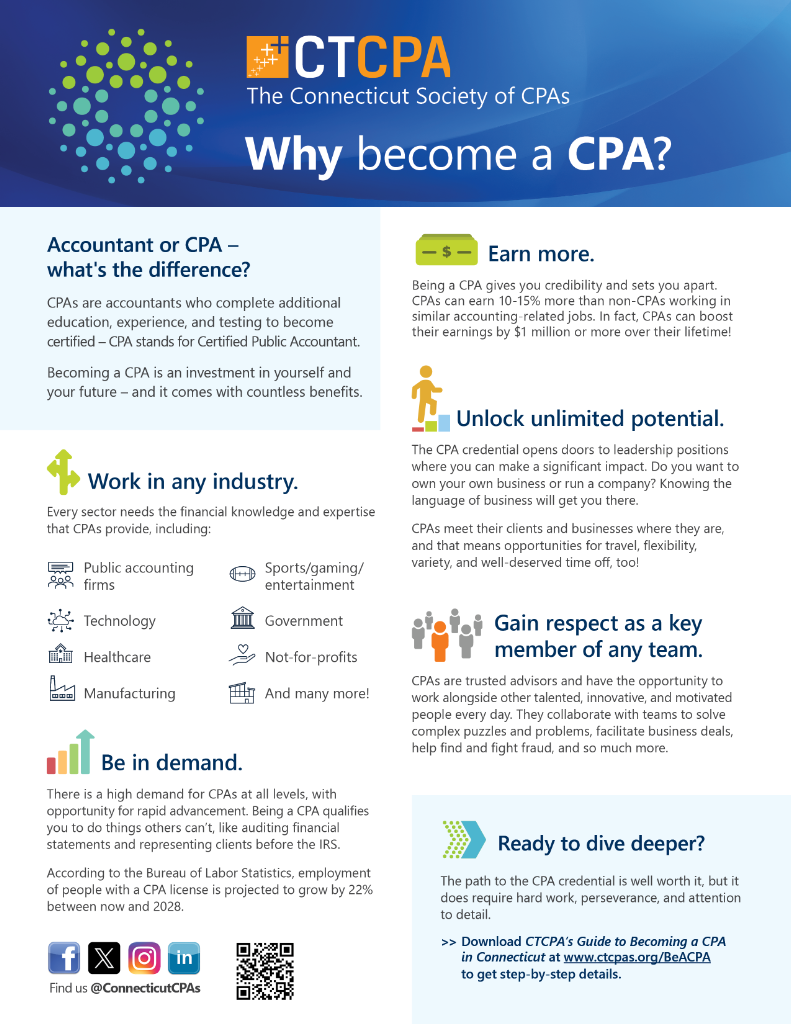

Certified public accountants are among the most trusted careers, and permanently reason. Not only do CPAs bring an unparalleled degree of expertise, experience and education to the procedure of tax obligation planning and handling your cash, they are specifically trained to be independent and objective in their job. A CPA will certainly help you safeguard your passions, pay attention to and address your concerns and, just as important, provide you peace of mind.In these important moments, a certified public accountant can supply greater than a general accounting professional. They're your relied on advisor, guaranteeing your service remains monetarily healthy and legitimately safeguarded. Hiring a local certified public accountant company can favorably impact your business's financial wellness and success. Right here are 5 essential benefits. A local CPA firm can help decrease your business's tax burden while making certain conformity with all suitable tax legislations.

This development reflects our devotion to making a positive effect in the lives of our clients. When you function with CMP, you come to be part of our household.

Unknown Facts About Frost Pllc

Jenifer Ogzewalla I have actually collaborated with CMP for several years currently, and I've truly valued their know-how and effectiveness. When bookkeeping, they function around my timetable, and do all they can to maintain continuity of workers on our audit. This saves me time and power, which is invaluable to me. Charlotte Cantwell, Utah Event Opera & Music Theater For extra motivating success tales and feedback from service proprietors, visit this site and see exactly how we have actually made a distinction for services like yours.

Right here are some key inquiries to direct your choice: Check if the CPA holds an active certificate. This assures that they have actually passed the needed tests and satisfy high moral and specialist requirements, and it reveals that they have the credentials to manage your economic issues sensibly. Verify if the CPA uses services that line up with your service demands.

Little companies have special financial demands, and a certified public accountant with pertinent experience can give more tailored advice. Inquire about their experience in your industry or with businesses of your size to guarantee they comprehend your details challenges. Understand how they charge for their solutions. Whether it's hourly, flat-rate, or project-based, knowing this upfront will avoid surprises and verify that their solutions fit within your budget plan.

Working with a neighborhood Certified public accountant company is more than just contracting out financial tasksit's a smart investment discover here in your business's future. CPAs are licensed, accounting specialists. Certified public accountants may function for themselves or as component of a company, depending on the setting.

Some Known Facts About Frost Pllc.

Tackling this responsibility can be a frustrating task, and doing something wrong can cost you both economically and reputationally (Frost PLLC). Full-service CPA companies recognize with filing needs to ensure your business adhere to government and state laws, in addition to those of financial institutions, financiers, and others. You might require to report extra earnings, which may require you to submit a tax obligation return for the very first time

group you can rely on. Get in touch with us for more details regarding our solutions. Do you comprehend the audit cycle and the steps associated with making certain correct financial oversight of your business's monetary well-being? What is your business 's lawful framework? Sole proprietorships, C-corps, S companies and partnerships are strained in a different way. The more complicated your income resources, venues(interstate or global versus neighborhood )and sector, the more you'll require a CPA. CPAs have a lot more education and learning and go through a rigorous qualification process, so they cost greater than a tax preparer or accountant. Generally, small companies pay in between$1,000 and $1,500 to hire a CERTIFIED PUBLIC ACCOUNTANT. When margins are limited, this expense might beout of reach. The months gross day, April 15, are the busiest season for CPAs, complied with by the months prior to the end of the year. You may have to wait to obtain your concerns addressed, and your income tax return could take longer to finish. There is a minimal variety of Certified public accountants to go around, so you might have a difficult time finding one specifically if you have actually waited until the eleventh hour.

CPAs are the" large guns "of the accounting industry and usually don't handle everyday audit tasks. Commonly, these other kinds of accountants have specializeds throughout locations where having a CPA certificate isn't required, such as management bookkeeping, not-for-profit accountancy, expense audit, government audit, or audit. As an outcome, using a bookkeeping solutions business is commonly a far much better value than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to support your sustain financial recurring effortsAdministration

CPAs additionally have know-how in creating and refining business policies and treatments and assessment of the functional demands of staffing models. A well-connected Certified public accountant can leverage their network to assist the company in numerous strategic and consulting functions, properly connecting the company to the optimal candidate to meet their requirements. Next time you're looking to load a board seat, consider getting to out to a Certified public accountant that can bring worth to your company in all the means noted above.

Report this page